nh property tax calculator

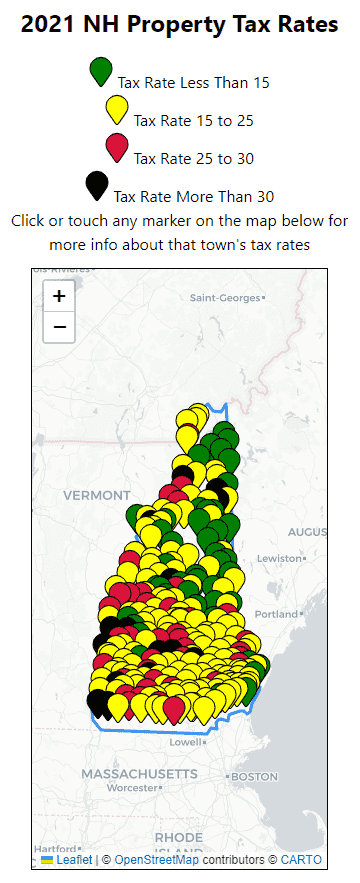

The 2021 tax rate is 2232 with an equalization rate of. The 2019 tax rate is 3105 with an equalization rate of 753.

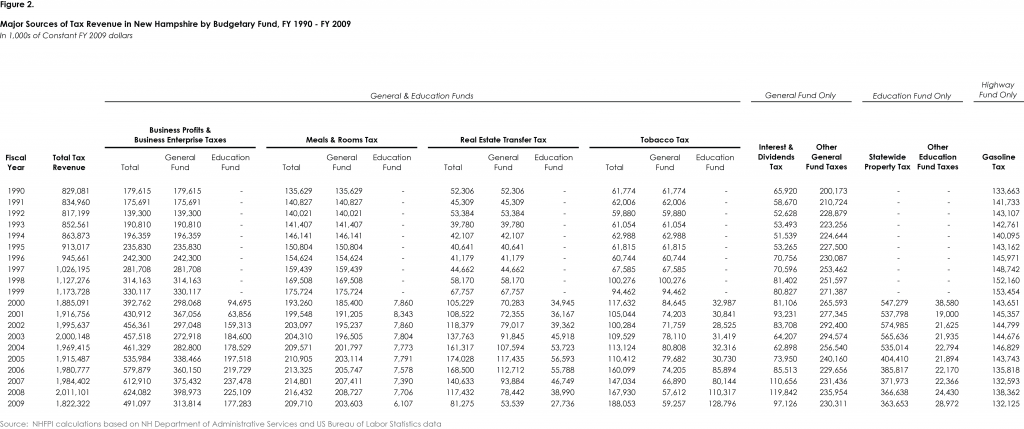

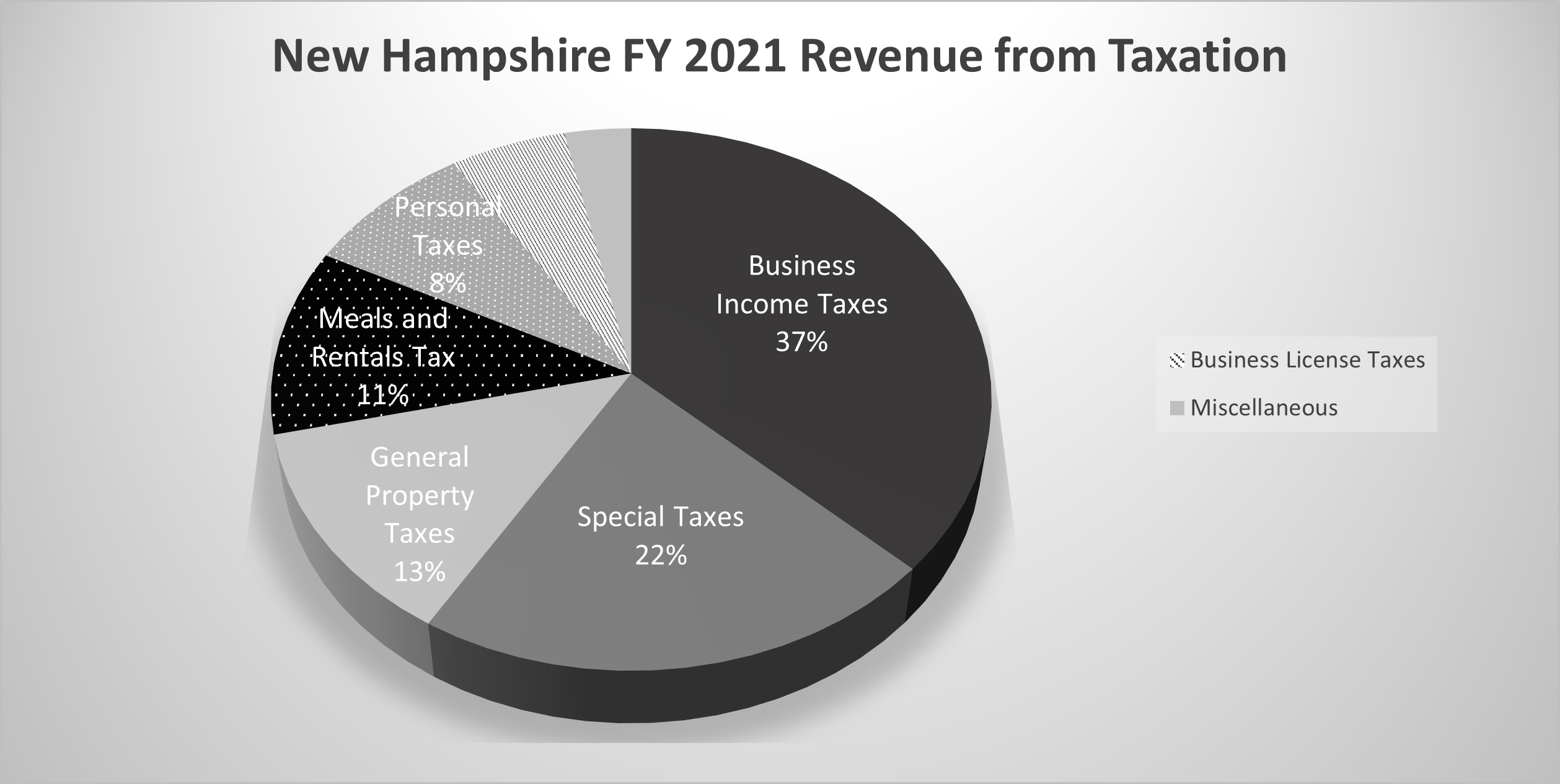

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Your average tax rate is 1198 and your marginal tax rate is 22.

. County Apportionments All State Education Property Tax Warrant. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our New Hampshire property tax records tool to get. Tax amount varies by county.

The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. Cooperative School District Apportionments All PDF Tax Rate Calculation Data. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our New Hampshire property tax records tool to get. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. New Hampshire Paycheck Calculator - SmartAsset.

The assessed value multiplied by the real estate tax rate. New Hampshire Real Estate Transfer Tax Calculator. This marginal tax rate.

New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Tax Rate Calculation Data. Assessing department tax calculator. How to Calculate Your NH Property Tax Bill.

The current real estate tax rate for the City of Franklin NH is 2321 per 1000 of your propertys assessed value. The assessed value multiplied by the tax rate equals the annual. Our Hillsborough County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Our Rockingham County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. The local tax rate where the property is. If you are buying a specific property find out what the actual taxes are for a full year and ask questions about the assessment.

The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. Look up your property tax rate from the table. The assessed value multiplied by the real estate.

Enter your Assessed Property Value Calculate Tax. Towns school districts and counties all set their own rates based on budgetary. Property tax bills in New Hampshire are determined using factors.

2013 City of Concord NH. 2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to. The assessed value of the property.

The 2020 tax rate is 2313 with an equalization rate of 913. New Hampshire has one of the highest. The state and a number of local government authorities determine the tax rates in New Hampshire.

Business Nh Magazine Nh Named A Most Tax Friendly State

The 2020 Hopkinton Property Tax Town Of Hopkinton Nh Facebook

Property Tax Bills Town Of New London Nh

Sales Taxes In The United States Wikipedia

Property Taxes Urban Institute

State Property Taxes Reliance On Property Taxes By State

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

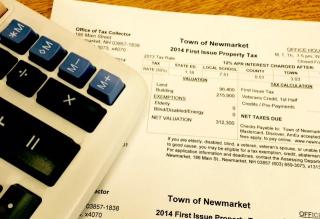

Newmarket Tax Rate Set At 25 46

2021 Tax Rate Set Town Of Nottingham Nh

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Nashua S Tax Rate Rises By 3 9 Covid 19 Brings Future Worries Nashua Nh Patch

Once Again Property Tax Survey Puts New Hampshire Near The Top Nh Business Review

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Rochester Nh Budget Taking Shape What It Could Mean For Your Taxes

Property Tax Is Biggest Burden For Nh Businesses Nh Business Review

Town Manager Announces Tax Rate Set At 26 36 Newmarket Nh

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News